By Luiz Filipe Evelin Arruda, Sam Schoenlank, and Antonia Egli (Dublin City University)

Join us as we continue to explore the open access book ‘Disrupting Buildings: Digitalisation and the Transformation of Deep Renovation’ and the innovative avenues and benefits that crowdfunding and blockchain-based solutions like tokenisation and smart contracts have to offer.

Efforts to achieve long-term net zero emissions necessitate addressing global building energy inefficiency, with around 75% of EU buildings requiring energy upgrades. While the Energy Efficiency Directive has been instrumental, the European Commission’s initiative to double annual energy renovation rates via the Renovation Wave strategy faces obstacles, notably the lack of resources for building renovation financing highlighted in the Open Consultation on the Renovation Wave.

To tackle these challenges, this chapter of ‘Disrupting Buildings‘ delves into how financial technology (FinTech) innovations could stimulate more private financing for building renovation. Despite the European Commission’s focus on digital and innovative technologies in construction, there has been minimal mention of financial technologies’ potential to alleviate barriers to building finance. The chapter reviews recent literature on financing building renovation, delineates key FinTech concepts, and scrutinises two prominent solutions—crowdfunding and blockchain-based technologies—as means to bridge the financing gap in renovation projects.

Deep Renovation Financing: Key Terms and Concepts

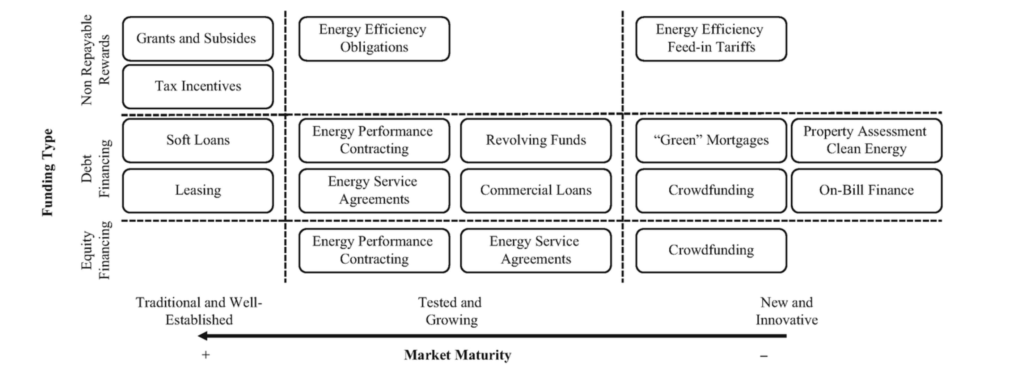

Economidou et al. (2019) offer an extensive overview of the primary financing instruments available for supporting energy renovations within the EU, characterising them based on their type and market saturation. These instruments encompass non-repayable rewards, debt financing, and equity financing, while their market saturation spans traditional, tested and growing, and new and innovative financing mechanisms. The landscape of energy renovation financing is depicted in Figure 1, illustrating the various funding types against market maturity. Additionally, Kunkel (2015) delineates the barriers to traditional investment in building renovation, such as upfront investment, information asymmetry, implementation quality, and split incentives, further exacerbated by the COVID-19 pandemic’s fiscal impact (Tian et al., 2022).

In response to the inadequacy of traditional funding mechanisms in meeting the escalating demand for building renovation capital, there is a growing interest in attracting more private investments (Tian et al., 2022). However, the construction sector remains largely reliant on debt-based solutions, underscoring the need for innovative financing approaches enabled by financial technologies (FinTech) (Ziegler et al., 2020). FinTech represents the convergence of finance and technology, offering novel platforms that facilitate access to capital for both investors and capital seekers, thereby overcoming traditional financial system limitations (Lynn & Rosati, 2021). Despite the widespread adoption of alternative finance sources in various sectors, the construction industry’s slow uptake suggests a significant opportunity for FinTech solutions to bolster building renovation efforts, aligning with the ambitious sustainability goals set by the EU and the United Nations (Economidou et al., 2019; United Nations, 2019).

Crowdfunding for Building Renovation

Crowdfunding emerges as a promising avenue for financing building renovation, offering a novel approach that circumvents the limitations of traditional bank financing. Panteli et al. (2020) emphasise the potential of crowdfunding to engage communities as shareholders in energy efficiency projects and foster greater community involvement in renewable energy initiatives. Despite its advantages in providing direct connections between investors and beneficiaries and lowering financing costs through technological facilitation (Bertoldi et al., 2021), crowdfunding also presents challenges such as the risk of inadequate funding for beneficiaries and investors assuming all associated risks (Economidou et al., 2011).

Crowdfunding’s suitability for small-scale energy upgrades underscores its potential contribution to the broader funding mix for building renovation, complementing both private-public and fully public funding mechanisms (Panteli et al., 2020). Kunkel (2015) outlines several merits of crowdfunding, including its ability to mitigate information asymmetry, enhance trust in local partners, and provide a platform for direct community involvement in projects. While empirical studies specific to building renovation crowdfunding are scarce, insights from real estate and renewable energy crowdfunding offer valuable perspectives (Montgomery et al., 2018; Cumming et al., 2017). These studies reveal factors influencing crowdfunding success, such as project duration, expected returns, and financial and non-financial project characteristics. Moreover, crowdfunding’s impact on renewable energy generation underscores its potential to drive tangible outcomes in sustainability initiatives (Appiah-Otoo et al., 2022). The role of platforms in facilitating crowdfunding activity, particularly in renewable energy projects, is crucial, with regulatory support and robust risk mitigation measures enhancing investor confidence and engagement (De Broeck, 2018).

Blockchain for Building Renovation

Blockchain technology, proposed by Satoshi Nakamoto in 2008 (Nakamoto, 2008), extends beyond cryptocurrency to various industries, including property management, smart cities, and energy efficiency (Arup, 2019). Khatoon et al. (2019) emphasise its role in energy trading, project financing, and supply chain tracking, especially for energy efficiency initiatives. Blockchain-based smart contracts ensure transparent trading of energy efficiency savings (Khatoon et al., 2019) and improve building information management (Liu et al., 2021). In energy performance contracting (EPC), blockchain streamlines processes and builds trust among stakeholders (Schletz et al., 2020), enabling decentralised crowdfunding through tokenisation (Schletz et al., 2020). Blockchain’s utility extends to real estate tokenisation, creating fractional ownership and secondary markets (Smith et al., 2019; Swinkels, 2022), and to digital twinning, simplifying data interactions between physical and virtual environments (Hunhevicz et al., 2022).

In sum, this chapter highlights the sparse literature on the convergence of financial technology and building renovation, presenting an opportunity for future research, particularly in non-blockchain and blockchain-based crowdfunding. The EU’s focus on revising the Energy Efficiency Directive emphasises the potential impact of timely research on building renovation policy. Despite the lack of empirical evidence, insights from real estate and renewable energy crowdfunding can inform understanding of the funding landscape for building renovation. Future studies should explore the effectiveness of tokenisation in funding renovation projects and evaluate the role of smart contracts in energy performance contracting. Empirical evidence on both the demand and supply sides, as well as comparisons with traditional crowdfunding, will be crucial for shaping future directions in financing building renovation.

To learn more about deep renovation technologies in general, you can download the open-access book ‘Disrupting Buildings: Digitalisation and the Transformation of Deep Renovation’ for free. In the book, we explore various digital innovations disrupting and transforming the construction sector. To download the full open-access book, ‘Disrupting Buildings,’ click here.

References

Appiah-Otoo, I., Song, N., Acheampong, A. O., & Yao, X. (2022). Crowdfunding and renewable energy development: What does the data say? International Journal of Energy Research, 46(2), 1837–1852.

Arup (2019). Blockchain and the Built Environment. https://www.arup.com/-/ media/arup/files/publications/b/blockchain-and-the-built-environment.pdf

Bertoldi, P., Economidou, M., Palermo, V., Boza-Kiss, B., & Todeschi, V. (2021). How to finance energy renovation of residential buildings: Review of current and emerging financing instruments in the EU. Wiley Interdisciplinary Reviews: Energy and Environment, 10(1), e384.

Cumming, D. J., Leboeuf, G., & Schwienbacher, A. (2017). Crowdfunding cleantech. Energy Economics, 65, 292–303.

De Broeck, W. (2018). Crowdfunding platforms for renewable energy investments: An overview of best practices in the EU. International Journal of Sustainable Energy Planning and Management, 15, 3–10.

Economidou, M., et al. (2011). Europe’s buildings under the microscope. A country- by- country review of the energy performance of buildings. Buildings Performance Institute Europe (BPIE). https://bpie.eu/wp-content/uploads/2015/10/ HR_EU_B_under_microscope_study.pdf

Economidou, M., Todeschi, V., & Bertoldi, P. (2019). Accelerating energy renovation investments in buildings. Publications Office of the European Union.

Hunhevicz, J. J., Motie, M., & Hall, D. M. (2022). Digital building twins and blockchain for performance-based (smart) contracts. Automation in Construction, 133, 103981.

Khatoon, A., Verma, P., Southernwood, J., Massey, B., & Corcoran, P. (2019). Blockchain in energy efficiency: Potential applications and benefits. Energies, 12(17), 3317.

Kunkel, S. (2015). Green crowdfunding: A future-proof tool to reach scale and deep renovation? In World sustainable energy days next 2014 (pp. 79–85). Springer. Palgrave Pivot.

Liu, Z., Chi, Z., Osmani, M., & Demian, P. (2021). Blockchain and Building Information Management (BIM) for sustainable building development within the context of smart cities. Sustainability, 13(4), 2090.

Lynn, T., & Rosati, P. (2021). New sources of entrepreneurial finance. Digital Entrepreneurship, 209.

Montgomery, N., Squires, G., & Syed, I. (2018). Disruptive potential of real estate crowdfunding in the real estate project finance industry: A literature review. Property Management.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Decentralized Business Review, 21260.

Panteli, C., Klumbyte, E., Apanaviciene, R., & Fokaides, P. A. (2020). An overview of the existing schemes and research trends in financing the energy upgrade of buildings in Europe. Journal of Sustainable Architecture and Civil Engineering, 27(2), 53–62.

Schletz, M., Cardoso, A., Prata Dias, G., & Salomo, S. (2020). How can blockchain technology accelerate energy efficiency interventions? A use case comparison. Energies, 13(22), 5869.

Smith, J., Vora, M., Benedetti, H., Yoshida, K., & Vogel, Z. (2019). Tokenized securities and commercial real estate. SSRN: 3438286.

Swinkels, L. (2022). Empirical evidence on the ownership and liquidity of real estate tokens. SSRN: 3968235.

Tasca, P. (2019). Token-based business models. In Disrupting finance (pp. 135–148).

Tian, J., Yu, L., Xue, R., Zhuang, S., & Shan, Y. (2022). Global low-carbon energy transition in the post-COVID-19 era. Applied Energy, 307, 118205.

United Nations. (2019). Harnessing digitalization in financing of the sustainable development goals. United Nations. https://unsdg.un.org/sites/default/f iles/2020-08/DF-Task-Force-Full-Report-Aug-2020-1.pdf

Ziegler, T., et al. (2020). The global alternative finance market benchmarking. Cambridge Centre for Alternative Finance. https://www.jbs.cam.ac.uk/wp-content/uploads/2020/08/2020-04-22-ccaf-global-alternative-financemarket-benchmarking-report.pdf

This project has received funding from the European Union's Horizon 2020 research and innovation programme under grant agreement No 892071.

This project has received funding from the European Union's Horizon 2020 research and innovation programme under grant agreement No 892071.